- Cash Flow U Chronicles

- Posts

- Craft Your Path to Prosperity

Craft Your Path to Prosperity

Bye-Bye, Financial Freakouts! (Part 3 of 3)

Empowering You 4 Innovative Cash Flow Ideas!

What's an Emergency Plan?

An emergency plan is a plan of action you implement when an emergency happens such as loss of job, car breaks down, child gets sick, or HVAC system breaks down.

Emergency Plan

Step 1: Make a Priority List

List all your expenses and rank them from most important (1) to least important (4). If an emergency hits, you'll know what to pay first and what can wait.

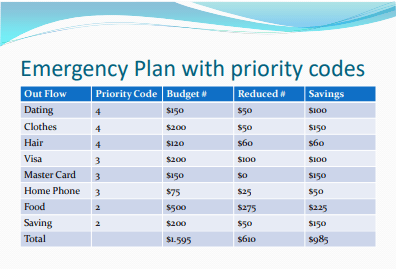

Step 2: Create a Chart

Make a chart with your expenses, their priority, how much you usually spend, how much you can cut back, and the savings. Practice this plan every year to make sure it still works.

Step 3: Activate the Plan

Use money from your emergency fund to pay your priority one bills first, then priority two, and so on. Hold off on paying lesser priority bills if you don’t have enough money in your emergency fund to pay them, but call your creditors to make them aware of your challenges.

Having this financial plan means you can face life's surprises with confidence. Start today, and your future self will thank you!

Step 4: Stay Motivated

Create a reward system that motivates you. Focus on the positive! Set small savings goals and celebrate when you hit them. These rewards keep you motivated. |  |

Examples of milestones are:

Reaching your total fund goal

Paying off a debt

Reducing an expense

Finding a new income source

When you eliminate an expense, keep saving that amount for another goal, like paying off more debt or saving for something fun like a vacation.

Recap

Setting up a solid emergency plan can make financial emergencies a thing of the past. It’s a marathon, not a sprint. Keep your goals realistic, automate your savings, and find creative ways to boost your income. Celebrate your progress to stay motivated.

Having this financial cushion means you can face life's surprises with confidence. Start today, and your future self will thank you!